The CMFAS training provided by professional trainers from Octen Consultancy will ensure that your candidates are fully prepared for the examination requirements outlined in Notice No. FAA-N26.

We are the preferred CMFAS training provider for major financial institutions in Singapore and would be happy to work with you. Our principal trainer has over 20 years of experience in the financial services industry and for more than a decade, he has delivered high-quality CMFAS training to thousands of financial professionals.

We offer a comprehensive range of CMFAS training programs, including:

1) CMFAS Training for RES5 – Rules, Ethics and Skills for Financial Advisory Services

RES5 is the common examination for all individuals intending to provide financial advisory services in Singapore. Our course design prioritises simplicity and comprehension for our participants. We accomplish this by incorporating our practical experiences and crafting presentations that are straightforward and digestible. We’ll equip you with the knowledge you need to ace the RES5, covering the Financial Advisers Act (FAA), Financial Advisers Regulations (FAR), relevant notices, and guidelines, as well as essential ethical principles and practical skills required for a representative.

2) CMFAS Training for M8 – Collective Investment Schemes

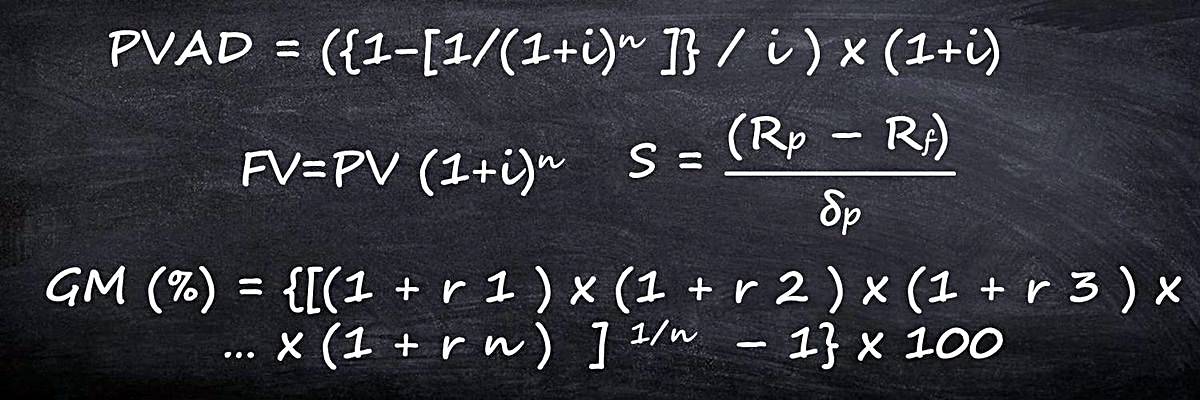

At the end of this course, your candidates will understand how various types of investments work. They will learn about the tools and techniques used to analyse, advise, and market collective investment schemes and unit trusts. We will also go through various types of calculation questions that are likely to be tested.

3) CMFAS Training for M8A – Collective Investment Schemes II

At the end of this course, your candidates will have an in-depth understanding of how structured products work. We will cover the governance structure, documentation and risks associated with the investment of structured products, particularly structured funds. In addition, your candidates will learn to evaluate structured funds on product features and inherent risks. They will also understand how structured funds perform under various market conditions in order to determine product suitability for clients. This course also discusses the various types of derivatives in the market, both on-the-exchange and over-the-counter.

4) CMFAS Training for CM-CIS: Collective Investment Schemes (M8+M8A)

This course equips participants with a comprehensive understanding of Collective Investment Schemes, including:

- Analysing, advising on, and marketing collective investment schemes and unit trusts.

- Calculating investment performance metrics relevant to exams.

- Structured products: governance, documentation, risks, evaluation, suitability assessment, and performance across market conditions.

- Various derivative instruments, both exchange-traded and OTC.

5) CMFAS Training for M9 – Life Insurance and Investment-Linked Policies

At the end of this course, your candidates will be able to make sense of complex life insurance concepts. They will acquire knowledge of how investment-linked policies (ILPs) work. We will also be teaching them how to solve different types of calculation questions for ILPs.

6) CMFAS Training for M9A – Life Insurance and Investment-Linked Policies II

At the end of this course, your candidates will have an in-depth understanding of how structured products work. We will cover the governance structure, documentation and risks associated with the investment of structured products, particularly structured ILPs. In addition, your candidates will learn to evaluate structured ILPs on product features and inherent risks. They will also understand how structured ILPs perform under various market conditions in order to determine product suitability for clients. This course also discusses the various types of derivatives in the market, both on the exchange and over-the-counter.

7) CMFAS Training for CM-LIP: Life Insurance And Investment-Linked Policies (M9+M9A)

This course equips participants with expertise in life insurance and investment-linked policies, including:

- Understanding complex life insurance concepts and the inner workings of Investment-Linked Policies (ILPs).

- Applying calculation methods relevant to ILPs.

- Analysing structured products, including governance, documentation, risks, and suitability assessment for clients.

- Evaluating how structured ILPs perform under different market conditions.

Exploring various derivative instruments, both exchange-traded and OTC.

8) CMFAS Training for CM-LIC: Life Insurance, Investment-Linked Policies And Collective Investment Schemes (M8+M8A+M9+M9A)

This course equips participants with a comprehensive understanding of Life Insurance, Investment-Linked Policies And Collective Investment Schemes, including:

- Analysing, advising on, and marketing collective investment schemes and unit trusts.

- Understanding complex life insurance concepts and the inner workings of Investment-Linked Policies (ILPs).

- Calculating investment performance metrics relevant to exams.

- Applying calculation methods relevant to ILPs.

- Structured products: governance, documentation, risks, evaluation, suitability assessment, and performance across market conditions.

- Various derivative instruments, both exchange-traded and OTC.

- Evaluating how structured ILPs perform under different market conditions.

9) Health Insurance (HI) Module

At the end of this course, your candidates will acquire knowledge of how different types of health insurance products work. In addition, the training covers the healthcare environment in Singapore and the different ways to finance healthcare needs. We will also be covering the common types of calculation questions in the examination.

For a copy of the detailed course outline and trainer’s profile, please click here.